Real Estate News

Be in the know about all things Real Estate

HUD awards $348K to 3 Fla. homeless veteran groups

WASHINGTON – July 5, 2016 – The U.S. Department of Housing and Urban Development (HUD) awarded $348,000 to three Florida groups that are working aggressively to end veteran homelessness. Nationwide, HUD awarded more than $5 million to 42 local public housing authorities.

HUD awarded the additional funds to help these housing authorities administer a joint program with HUD and the U.S. Department of Veterans Affairs (VA) to provide permanent homes and needed services to veterans experiencing long-term, chronic homelessness.

Florida homeless veteran groups

Broward County Housing Authority, Lauderdale Lakes: $175,928

.Jacksonville Housing Authority, Jacksonville: $59,424

HA Daytona Beach, Daytona Beach: $112,563

Florida total: $347,915

"These housing authorities are going above and beyond in the movement to end veteran homelessness," says Lourdes Castro-Ramirez, HUD's Principal Deputy Assistant Secretary for Public and Indian Housing. "Today we reward those who are out there doing the heavy lifting to find real and lasting housing solutions for veterans who might otherwise be living on our streets."

The local PHAs receiving these additional fees are making aggressive efforts to house veterans. The agencies are also launching marketing campaigns and hosting Landlord Fairs to recruit landlords/property owners to participate in the program. In addition, these agencies are hiring temporary staff to provide additional housing search assistance, expedite processing of documentation, inspect units, issue vouchers and execute leases.

© 2016 Florida Realtors®

Source: http://www.floridarealtors.org

National flood insurance program expires in Oct.

WASHINGTON – July 5, 2016 – Flood insurance costs continue to put small businesses and homeownership at risk, the National Association of Realtors® (NAR) told U.S. Senators last week in testimony before Congress. But NAR also talked about possible solutions for the National Flood Insurance Program (NFIP).

The 2016 vice chair of NAR's Insurance Committee, David McKey, testified on NAR's behalf before the Senate Small Business and Entrepreneurship committee. McKey told Senators that Realtors say that excessive flood insurance costs and future uncertainty continue to plague clients.

"Despite everything that's been done on this issue, the threat of a $30,000 flood insurance premium still looms," said McKey. "A few years ago, the uncertainty over future rate increases was enough for buyers to direct Realtors not to show them any listings in the floodplain," he said. "That's enough to worry business owners and homeowners alike, and it's something that needs to be addressed."

Kevin Robles, a homebuilder from Tampa Bay also testified before the committee. He said that Florida housing prices are still 22 percent below normal due to the Great Recession.

"Any negative change to the market – such as flood insurance rate increases – could have long-term unintended consequences to Florida's economy," he said. "I am a small business owner and at least a quarter of my customer base is active or retired military. I am constantly reminded of the need to keep housing prices affordable. In Florida, for every $1,000 increase in home prices, more than 8,000 households are priced out of the market."

McKey praised the "Homeowner Flood Insurance Affordability Act" that became law in 2014 and reined in the most inaccurate rate increases across the country. Before the Affordability Act, thousands of small business owners faced immediate and excessive rate increases under FEMA's implementation of the "Biggert Waters Flood Insurance Reform Act of 2012."

But McKey warned the committee that significant concerns still remain. Even now rates continue to rise exponentially by 25 percent each year until policyholders reach their "full-cost rate."

A business or homeowner who wants to prove they've reached their full-cost rate must hire a licensed surveyor and provide a costly elevation certificate to the Federal Emergency Management Agency (FEMA). If the certificate shows that owners have reached full cost, they may request an optional full-risk rating to end the 25 percent increases. Otherwise, the increases continue.

The current system creates what McKey described as an "endless escalator" of rising costs for businesses and homeowners.

Although it isn't possible to determine how many properties will ultimately be affected, current estimates show that roughly 1 million properties have subsidized insurance rates that may be subject to significant increases.

McKey reiterated NAR's support for a range of solutions to address the problem, including:

Reauthorize the National Flood Insurance Program that sunsets in October 2017

Use advanced technology to improve the accuracy of flood maps to determine how many owners face unaffordable rates and reduce the number of property owners who have to file expensive appeals

Foster a private insurance market to complement the NFIP

McKey also suggested a NAR-backed strategy for actually preventing flood damage. By authorizing the use of funds to proactively mitigate properties located in hazard areas, McKey noted that it's possible to protect property owners while saving taxpayers' money. This might include flood proofing, elevating or otherwise strengthening a property.

Funding is currently available for these mitigation efforts, but property owners typically can't tap into them until after a flood occurs and, after that, costs are higher and the damage has already been done.

"Realtors see the effect of rising flood insurance rates firsthand in their businesses and in the local communities," McKey said. "But commonsense solutions to the problem are well within reach. NAR is thankful for the opportunity to testify and applauds the Committee's attention to this important issue."

© 2016 Florida Realtors®

Source: http://www.floridarealtors.org

This really ticks off buyers and sellers

WASHINGTON – July 8, 2016 – Missed appointments, the impersonal nature of real estate transactions, scheduling struggles and sellers who linger during showings are just a few of the common gripes from buyers and sellers, according to a recent article in The Washington Post.

One couple said they received a text message from their real estate agent saying that potential buyers wanted to view their home within a certain timeframe. The couple made their house available, despite the hassle – the husband had to conduct a two-hour work call from his car and the wife had to keep the pets out of the house for two hours. But the buyers never showed up, which angered the sellers. And then they grew even angrier after the buyer's agent never contacted them to apologize.

"We contacted the buyers' agent and her manager and never got an apology from either of them," the couple says. "Our Realtor® followed up as well and reported back that the buyers' agent had blamed the buyers for not being available because they have a baby and it's hard to get out of the house. But that doesn't explain why she didn't contact us either time to let us know they wouldn't be coming."

The couple also says that the "lack of personal touch" in real estate irks them. "Even with your own Realtor, almost everything is done by e-mail, including when it was time to renew our listing contract."

Even finding an agreeable time to look at a property can be a logistical nightmare.

"It's surprising when sellers insist that buyers can come in only during limited hours or respond negatively to requests to visit a property," says Jami Harich, an agent with Avery Hess Realtors. "They'll say it isn't a good time. But when your buyer wants to see multiple properties, they sometimes just skip the one that isn't easy to see."

To avoid this situation, it's important for sellers agents to stress the importance of a flexible schedule to their clients.

Some buyers say they're not happy if sellers refuse to leave when they're trying to view a home. Eldad Moraru, a real estate pro with Long & Foster Real Estate in Bethesda, Md., says that's one of the biggest complaints he gets from buyers.

"The worst is sellers who follow the buyers around to show them features or talk about the place," Moraru told The Washington Post. "Buyers feel as if they're intruding and won't even look at the house." Moraru says that if sellers are present in the house when his buyers are looking he tries to engage them in conversation so the buyers have a chance to look around in quiet.

Moraru says that sometimes listing agents don't make it clear enough to homeowners that it's important to leave the home for listing appointments. However, he also admits that some homeowners just don't listen.

Source: "Home Buyers and Sellers Can Drive One Another Up the Wall," The Washington Post (June 23, 2016)

© Copyright 2016 INFORMATION, INC. Bethesda, MD (301) 215-4688

Source: http://www.floridarealtors.org

Fla.’s foreclosure rate dropping, state now No. 4

IRVINE, Calif. – July 14, 2016 – While Florida continues to have a higher number of foreclosures, the total number continues to drop, and the state's U.S. ranking is in decline as it moves from its often No. 1 spot down to No. 4 in RealtyTrac's 2016 U.S. Foreclosure Market Report.

New Jersey now tops RealtyTrac's foreclosure-rate list (0.98 percent of housing units with a foreclosure filing) followed by Maryland (0.90 percent) and Delaware (0.78 percent). In fourth place, Florida (0.70 percent) still outranks its long-time competitor for the top spot, Nevada (0.68 percent).

The top 10 list of foreclosure-rate states for the first six months of 2016 is rounded out by Illinois (0.61 percent), Ohio (0.54 percent), South Carolina (0.54 percent), Connecticut (0.48 percent) and Indiana (0.47 percent).

In a look at foreclosure rates by metro area, Florida has three cities in the top 10: Lakeland-Winter Haven was No. 4 (0.91 percent), Tampa-St. Petersburg was No. 8 (0.85 percent) and Jacksonville was No. 9 (0.80 percent). The top U.S. foreclosure cities were Trenton, New Jersey (1.31 percent) and Baltimore (0.96 percent).

"South Florida saw a 34 percent drop in foreclosure filings year-over-year," says Mike Pappas, president and CEO at Keyes Company. "With strong employment, low interest rates and with lenders continuing to carefully scrutinize borrowers – foreclosures will soon be at the lowest levels in a decade."

The length of time it takes from first foreclosure notice to final judgment continues to impact the Florida market. In the state with the longest foreclosure timeline, New Jersey, it takes 1,249 days. It's followed by Hawaii (1,236 days), New York (1,058 days), Utah (1,025 days) and Florida (1,012 days)

According to RealtyTrac, investors buy 1 in 4 foreclosed homes: 27 percent of all properties sold at foreclosure auction were purchased by third-party investors. It's the highest share for the first six months of any year since 2000 – the earliest national data is available.

National foreclosure details

The U.S. had a total of 533,813 U.S. properties with foreclosure filings – default notices, scheduled auctions or bank repossessions – in the first six months of 2016, down 20 percent from the previous six months and down 11 percent from the first six months of 2015.

Counter to the national trend, 19 states posted year-over-year increases in foreclosure activity in the first half of 2016. Among the nation's 20 most-populated metro areas, five posted year-over-year increases in foreclosure activity.

"Although there are some local outliers, the downward foreclosure trend continued in the first half of 2016 in most markets nationwide," says Daren Blomquist, senior vice president at RealtyTrac.

"While U.S. foreclosure activity is still above its pre-recession levels, many of the states hit hardest by the housing crisis have now dropped below pre-recession foreclosure activity levels," he adds. "With some exceptions, states with foreclosure activity continuing to run above pre-recession levels tend to be those with protracted foreclosure timelines still working through legacy distress from the last housing bust."

States where Q2 2016 foreclosure activity was still above pre-recession averages: Florida (26 percent above pre-recession levels), New Jersey (215 percent above), Illinois (36 percent above), New York (127 percent above), Indiana (2 percent above), South Carolina (376 percent above), Massachusetts (127 percent above) and Washington (29 percent above).

© 2016 Florida Realtors®

Source: http://www.floridarealtors.org

Is Now the Right Time to Put Your House on the Market …or Not?

by The KCM Crew on July 7, 2016 in For Sellers, Housing Market Update

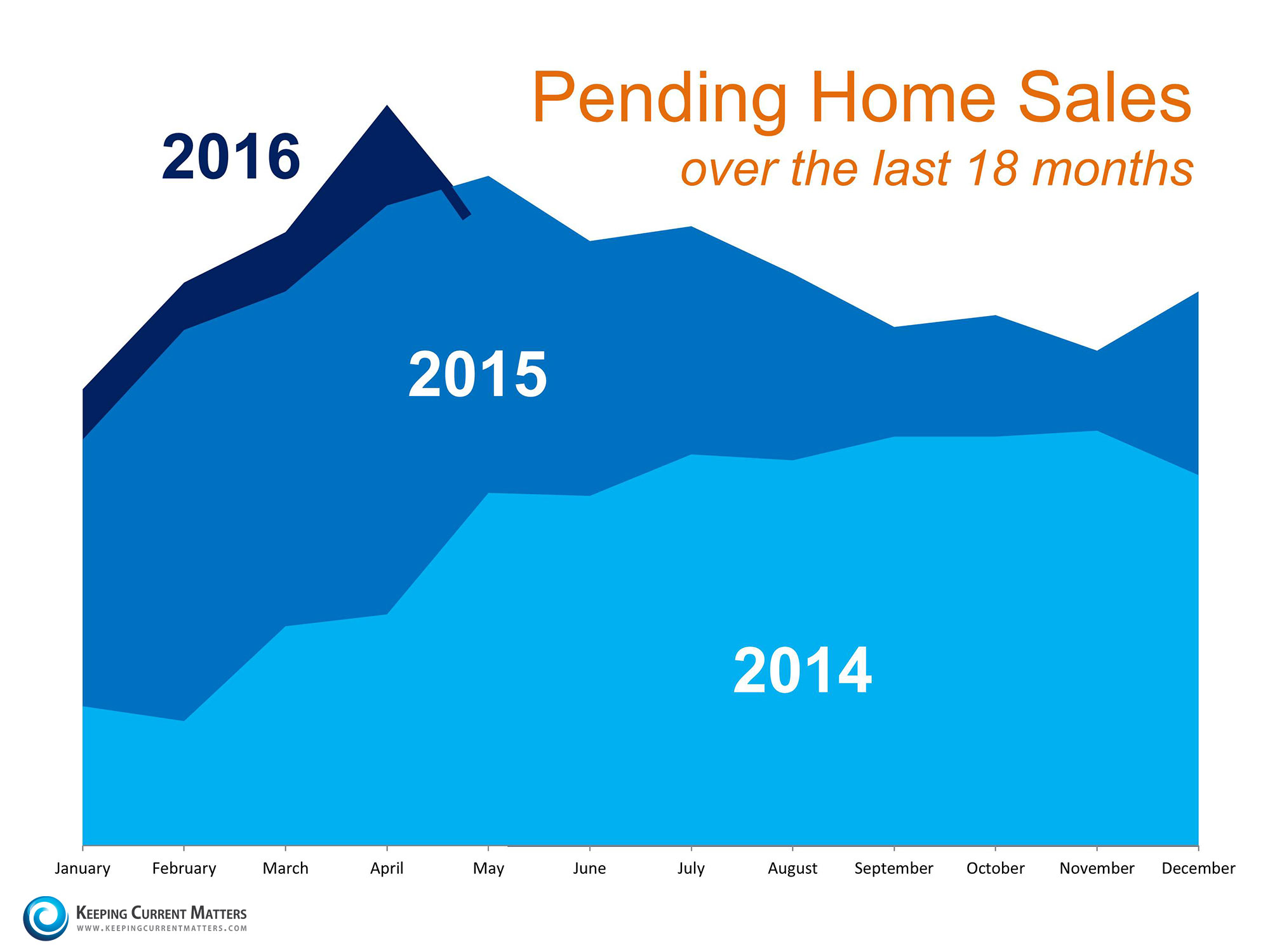

Last week, the National Association of Realtors (NAR) released their Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings. The report revealed that this May’s numbers weren’t quite as good as the year before:

“With last month’s decline, the index reading is still the third highest in the past year, but declined year-over-year for the first time since August 2014.”

The mainstream media ran headlines highlighting that the index had dropped for the first time in two years. Many read this as an indication that the housing market must be slowing down.

If you were thinking that now may be the perfect time to put your house on the market, these reports may have caused you some concern. We want to alleviate that concern today.

Though it is true that the index dropped in last month’s report, let’s take a closer look at the numbers. Below is a graph of the index since January 2014. We can see that the index has increased every month over the last eighteen months, leading up to this past May.

Lawrence Yun, Chief Economist at NAR, explained that it wasn’t a slowing of the market that caused the index to slip, but instead a lack of housing inventory:

“Total housing inventory at the end of each month has remarkably decreased year-over-year now for an entire year. There are simply not enough homes coming onto the market to catch up with demand.”

Here is a graph depicting the situation Yun was referencing:

Bottom Line

Did the latest numbers from the Pending Home Sales Index cause you to question if now is a good time to put your house on the market? If anything, it indicated the exact opposite: that this may be the perfect time to sell!!

Source: keepingcurrentmatters.com

Would You Qualify for a Mortgage Now?

by The KCM Crew on July 13, 2016 in First Time Homebuyers, For Buyers

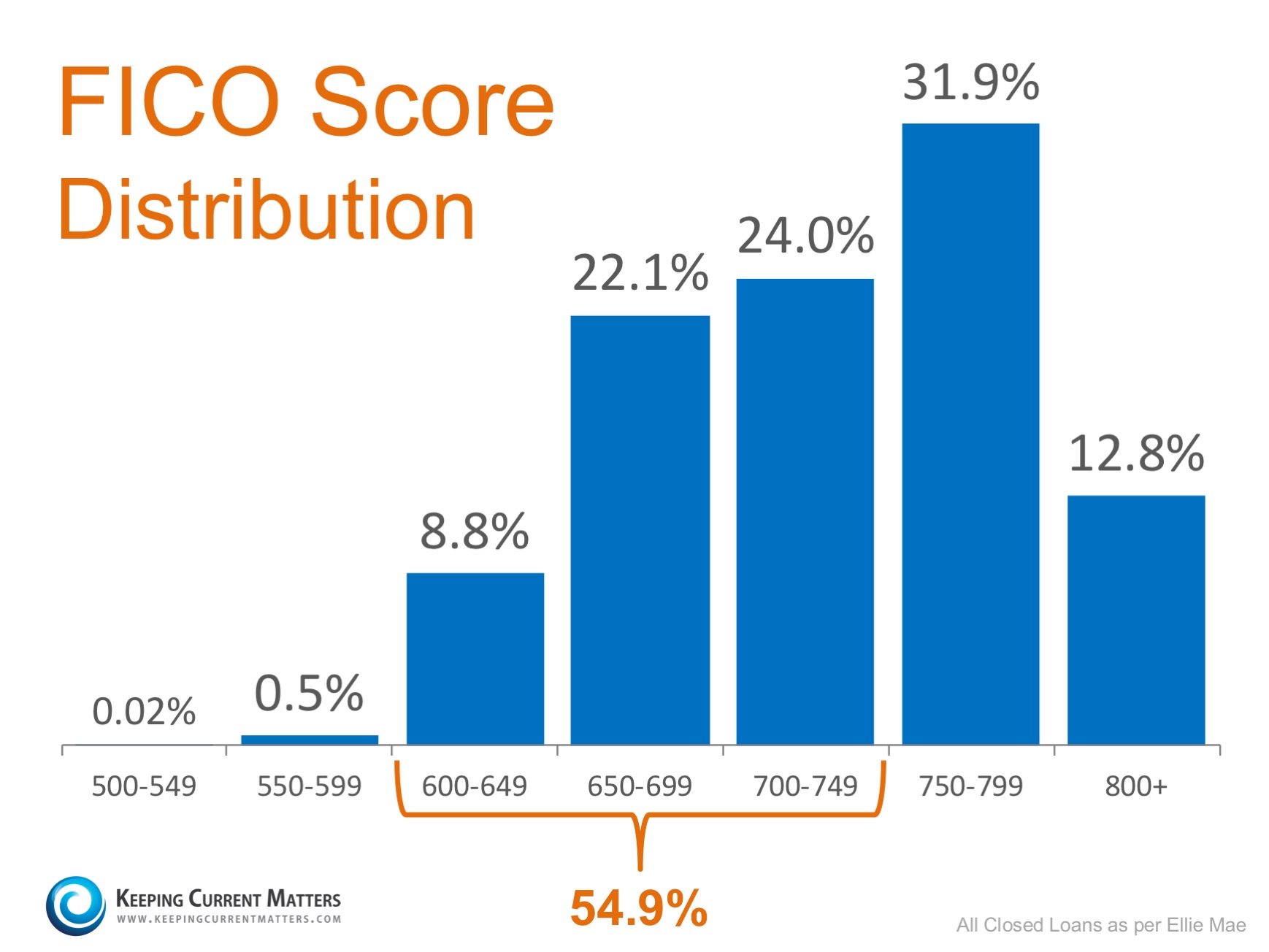

The widespread myth that perfect credit and large down payments are necessary to buy a home are holding many potential home buyers on the sidelines. According to Ellie Mae’s latest Origination Report, the average FICO score for all closed loans in May was 724, far lower than the 750 or 800 that many buyers believe to be true.

Below is a graph of the distribution of FICO scores of approved loans in May (the latest available data):

Looking at the chart above, it becomes obvious that not only do you not need a 750+ credit score, but 54.9% of approved loans actually had a score between 600 and 749. More and more experts are speaking up about the fact that if potential buyers realized they could be approved for a mortgage with a credit score at, or above, 600, the distribution in the chart above would shift further to the left. Ellie Mae’s Vice President, Jonas Moe encouraged buyers to know their options before assuming that they do not qualify for a mortgage:

The high median credit score is due to many millennials believing they won’t qualify with the score they have - and are therefore waiting to apply for a mortgage until they have the score they think they need.” (emphasis added)

CoreLogic’s latest MarketPulse Report agrees that the median FICO score does not always tell the whole story:

“The observed decline in originations could be a result of potential applicants being either too cautious or discouraged from applying, more so than tight underwriting as the culprit in lower mortgage activity.”

It’s not just millennials who believe high credit scores and large down payments are needed. Many current homeowners are delaying moving on to a home that better fits their current needs due to a belief that they would not qualify for a mortgage today.

So what does this all mean?

Moe put it this way:

Many potential home buyers are 'disqualifying' themselves. You don't need a 750 FICO Score and a 20% down payment to buy.”

Bottom Line

If you are one of the many Americans who has always thought homeownership was out of their reach, meet with a local real estate professional who can help you start the process of being pre-qualified to see if you are able to buy now!

Source: keepingcurrentmatters.com

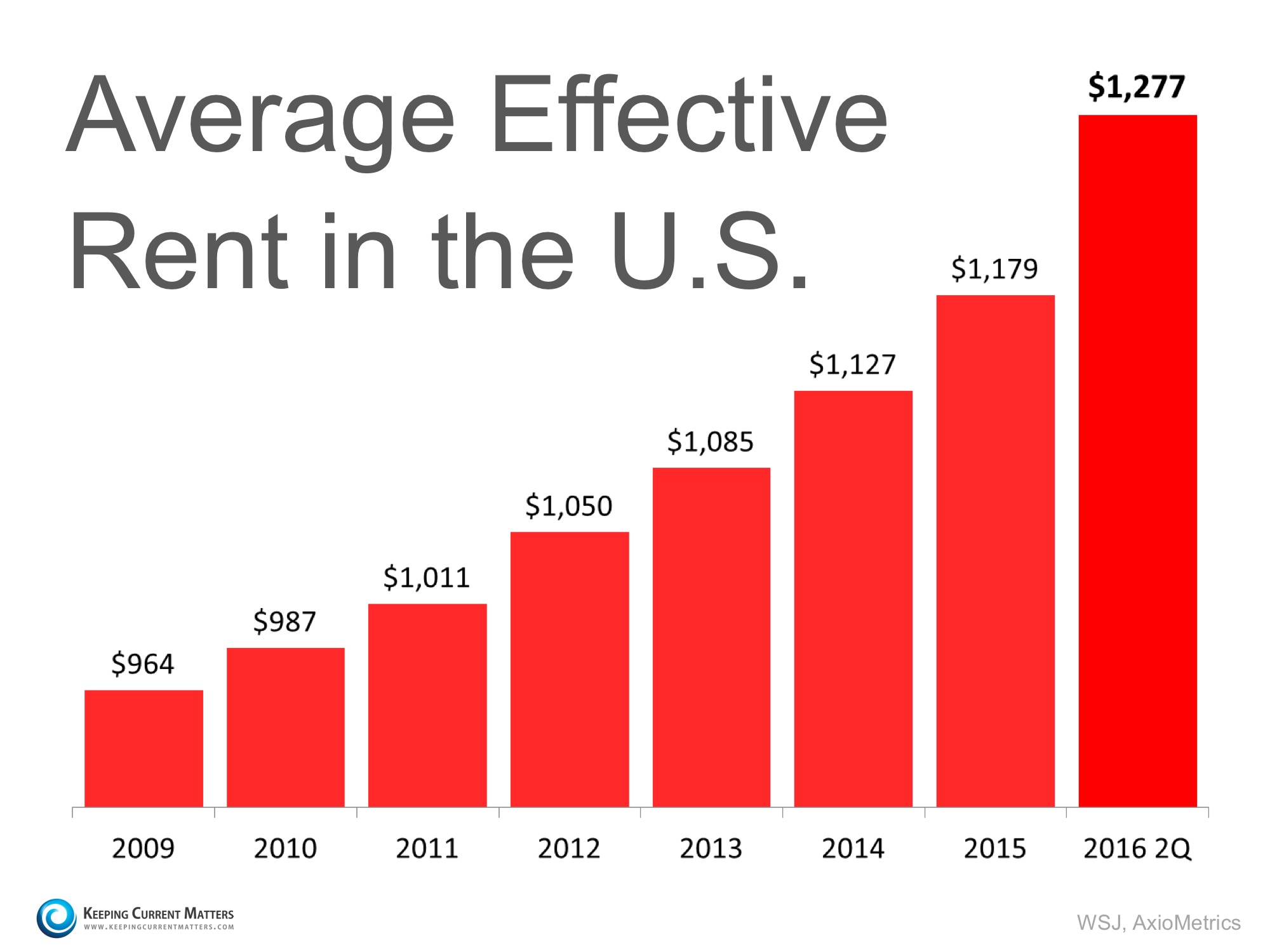

Rents Skyrocket at Highest Rate in almost a Decade

by The KCM Crew on July 20, 2016 in First Time Homebuyers, For Buyers

The Consumer Price Index (CPI) was released by the Labor Department last week. An analysis by Market Watch revealed the cost of rent was 3.8% higher than a year ago for the second straight month in June. That’s the strongest yearly price gain since 2007.

This coincides with a report released earlier this month in which AxioMetrics announced that rents are continuing to increase in 2016. The report revealed:

• There was a 3.7% increase in effective rents in the second quarter of 2016 as compared to the same period last year.

• That the effective rent growth this quarter compared to last quarter was 2.3%

• Annual effective rent growth was positive in 49 of the top 50 markets, based on number of units. Only Houston was negative, at -1.4%, as the fallout from energy-industry job losses and excess construction continues.

Here is a graph to illustrate the rate of increase over the last several years:

Bottom Line

With rents continuing to rise and mortgage interest rates still at historic lows, meet with a local real estate professional who can help determine if you could turn your monthly rental cost into a home of your own.

Source: keepingcurrentmatters.com

US Housing Market Swings in Favor of Homeownership

By The KCM Crew on June 14, 2016 in First Time Homebuyers, For Buyers, Move-Up Buyers

According to the latest Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index,homeownership is a better way to produce greater wealth, on average, than renting. The results from the first quarter index showed that “16 of the 23 metropolitan markets investigated moved in the direction of buy territory.”

The BH&J Index is a quarterly report that attempts to answer the question:

Is it better to rent or buy a home in today’s housing market?

“The U.S. housing market, when considered as a whole, has swung marginally more in favor of home ownership over renting a comparable property and investing monthly rent savings in a portfolio of stocks and bonds.”

The latest results were released shortly after the S&P/Case-Shiller Home Price Index, which reported that home prices had climbed 5.4% nationally since March 2015.

Ken Johnson Ph.D., Real Estate Economist & Professor at Florida Atlantic University, and one of the index’s authors states:

“This [growth] appears to be driven by a steady but strengthening job market, rising rents relative to rising ownership costs and recent slower growth in traditional financial portfolios consisting of stocks and bonds.”

Dallas and Denver are two of the major cities that continued to move deeper into rent territory, but they moved at a slower rate than they had in previous quarters. Johnson believes that, in these two markets, “strong economic support…should make for a soft landing in terms of slowing property price growth, increased marketing time for properties and lower probabilities that sellers will actually transact and close during a given marketing effort of their property.”

Bottom Line

Buying a home makes sense socially and financially. Rents are predicted to increase substantially in the next year, so lock in your housing cost with a mortgage payment now.

To Find Out More About the Study: The BH&J Index and other FAU real estate activities are sponsored by Investments Limited of Boca Raton. The BH&J Index is published quarterly and is available online at http://business.fau.edu/buyvsrent.

Source: keepingcurrentmatters.com

Former Rays owner Vince Naimoli's Avila home finally sells for $3.9M, a fraction of original asking price

Thursday, June 9, 2016 2:20pm

TAMPA — More than six years after it first hit the market, the Avila estate of former Tampa Bay Rays owner Vince Naimoli has finally sold — at less than a third of the original asking price.

Multiple Listing Service records show that the lakefront home closed last week for $3.9 million, a 72 percent drop from its peak price of $14 million. The deed had not been recorded as of Thursday afternoon, but one of the agents involved in the sale said the buyers already live in Avila but wanted a bigger home.

Naimoli, a founder of a Fortune 500 glass manufacturer, built the Tudor-style mansion on 10 acres on Lake Chapman in 1995. That year, he led the drive to bring the then-Devil Rays to town, running the franchise for a decade before ceding control to a new owner.

Naimoli and his wife, Lenda, first tried to sell the 15,500-square-foot house for $14 million in 2009 when housing prices were in a deep dive. They dropped the price to $11 million a year later, then took it off the market when no buyers emerged.

In June 2013, as the market began to revive, the couple listed the home for $9.995 million. When it still failed to move, they tried to sell it at a much-publicized auction in November 2014. In a news release announcing the auction, Lenda Naimoli described watching hot air balloons float over the house, which she said "has stunning morning views of the lake."

"We are ready to move forward and have purchased a smaller property in the Avila community," her husband said in the same release, referring to a 3,436-square-foot home that the couple still owns.

The auction also failed to produce any buyers, and over the next two years the price fluctuated from $5.5 million to $4.8 million to $5 million and back down to $4.8 million.

In March, the house finally went under contract.

"It was always too much," listing agent Frank Ambrosio said of the previous prices. "It was never where it should have been or it would have sold before now.

"Unusually, the home was listed by agents for two different firms — Ambrosio of Berkshire Hathaway and Michelle Fitz-Randolph of Coldwell Banker. The selling agent was Dianne Martin of Century 21 Shaw Realty Group.

Martin was the listing agent in another high-profile, deeply discounted Avila transaction, the 2014 sale of former gold dealer Mark Yaffe's palatial home for $5.58 million. That was 78 percent less than its original $25 million asking price.

Tampa Bay's luxury market has picked up since then — five homes have sold for more than $5 million this year and three more are under contract. No sales topped $5 million last year.

The $3.9 million for Naimoli's estate is the most paid for any Avila home in the past six months.

Source: tampabay.com

The oceanfront house in Hammock Dunes has 7,502 square feet.

by: Lisa Wolfe Staff Writer

A Hammock Dunes home is the top home on the market, listed at $5,340,000. The home features ocean views from every room with a private beach walkover and a 50-foot pool. Peruvian walnut wood and coral cover the floors throughout the home. The home on Granada Drive boasts six bedrooms, 7.5 bathrooms and 7,502 square feet of living space.

VIEW FULL GALLERY

Source: palmcoastobserver.com

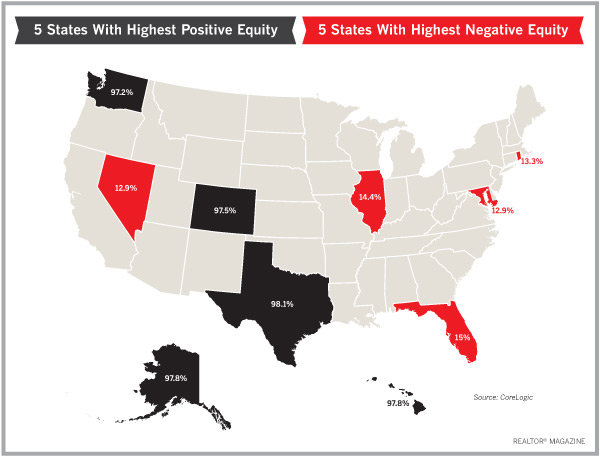

92% of Mortgaged Properties Have Equity

DAILY REAL ESTATE NEWS | MONDAY, JUNE 13, 2016

More home owners now have equity. About 46.7 million residential properties with a mortgage had equity at the end of the first quarter of 2016, according to data from CoreLogic. Home equity rose year-over-year by $762 billion.

In the first quarter alone, 268,000 home owners regained equity, which boosted the percentage to 92 percent of all mortgaged properties with equity.

“In just the last four years, equity for home owners with a mortgage has nearly doubled to $6.9 trillion,” says Frank Nothaft, chief economist for CoreLogic. “The rapid increase in home equity reflects the improvement in home prices, dwindling distressed borrowers and increased principal repayment. These are all positive factors that will provide support to both household balance sheets and the overall economy.”

More than 1 million home owners have escaped the negative equity trap over the past year, adds Anand Nallathambi, president and CEO of CoreLogic.

“We expect this positive trend to continue over the balance of 2016 and into next year as home prices continue to rise,” says Nallathambi. “If home values rise another 5 percent uniformly across the U.S., the number of underwater borrowers will fall by another one million during the next year.”

Still, 4 million -- or 8 percent of all homes with a mortgage -- remain in negative equity territory. But the number of negative equity properties has been steadily dropping. In comparison to the fourth quarter of 2015, negative equity properties dropped 21.5 percent year-over-year.

Five states accounted for 30.2 percent of negative equity in the U.S. The states with the highest percentage of homes in negative equity are: Nevada (17.5%); Florida (15%); Illinois (14.4%), Rhode Island (13.3%); and Maryland (12.9%).

On the other hand, the states with the highest percentage of homes with positive equity in the first quarter are: Texas (98.1%); Alaska (97.8%); Hawaii (97.8%), Colorado (97.5%); and Washington (97.2%).

Source: CoreLogic

Source: realtormag.realtor.org

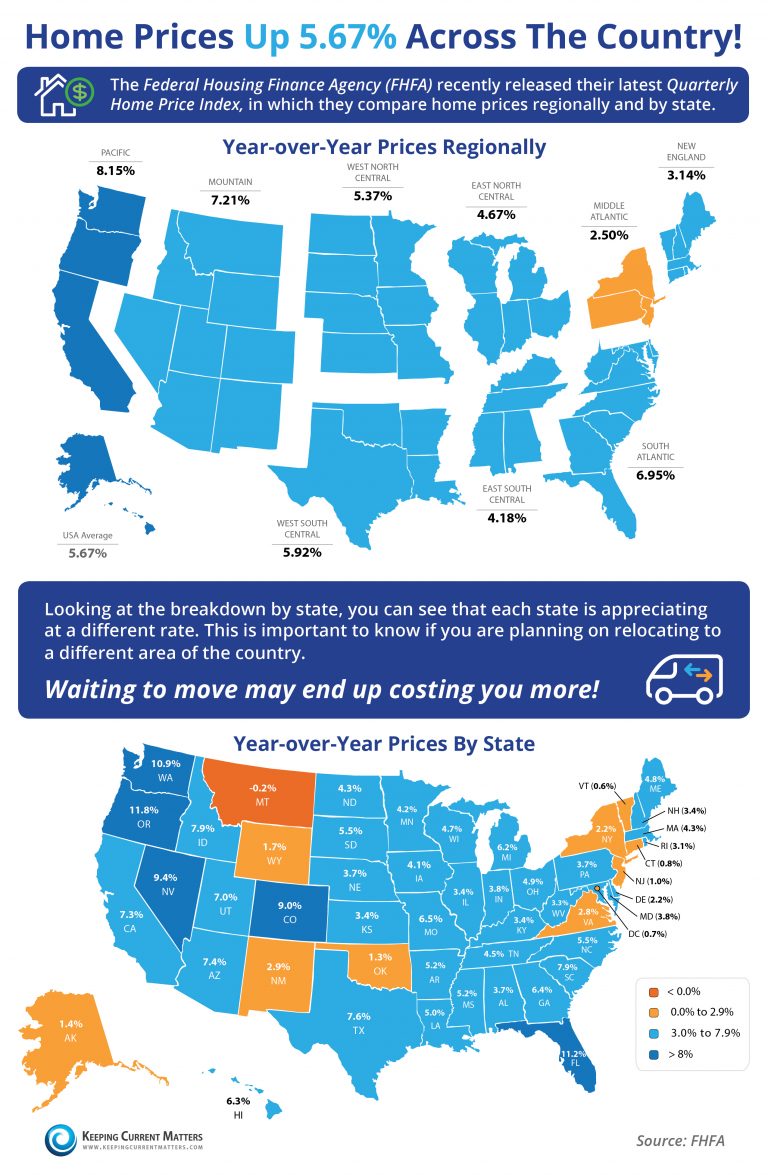

Home Prices Up 5.67% Across The Country!

By The KCM Crew on June 10, 2016 in For Buyers, For Sellers, Infographics, Pricing

Some Highlights:

• Across the country, home prices are up by 5.67%.

• Each state is appreciating at a different rate, however, which is important to realize if you plan on relocating to a different state.

• Regionally, prices have appreciated year-over-year by as high as 8.15%.

Source: keepingcurrentmatters.com

The Presidential Election and Its Impact on Housing

By The KCM Crew on May 19, 2016 in First Time Homebuyers, For Buyers, Housing Market Update

Every four years people question what effect the Presidential election might have on the national housing market. Let’s take a look at what is currently taking place. The New York Times ran an article earlier this week where they explained:

“A growing body of research shows that during presidential election years — particularly ones like this when there is such uncertainty about the nation’s future — industry becomes almost paralyzed. A look at the last several dozen election cycles shows that during the final year of a presidential term, big corporate investments are routinely postponed, and big deals are put on the back burner.

The research is even more persuasive on the final year of an eight-year presidential term, when a new candidate inevitably will become president.”

We are seeing this take form in the latest economic numbers. However, will this lead to a slowdown in the housing market? Not according to Fannie Mae, Freddie Mac or theNational Association of Realtors.

The Impact on Housing Throughout 2016

Let’s look at what has happened and what is projected to happen by these three major entities.

National Association of Realtors

“In spite of deficient supply levels, stock market volatility and the paltry economic growth seen so far this year, the housing market did show resilience and had its best first quarter of existing-sales since 2007.”

Freddie Mac

“Recent data darkened the growth outlook for the first quarter of 2016. However, despite the disappointing economic reports, we still forecast housing to maintain its momentum in 2016.”

Fannie Mae

“Consumers and businesses showed caution at the end of the first quarter…(but) Home sales are expected to pick up heading into the spring season amid the backdrop of declining mortgage rates, rising pending home sales and purchase mortgage applications, and continued easing of lending standards on residential mortgage loans.”

Bottom Line

Even during this election year, the desire to achieve the American Dream is greater than the fear of uncertainty of the next presidency.

Source: keepingcurrentmatters.com

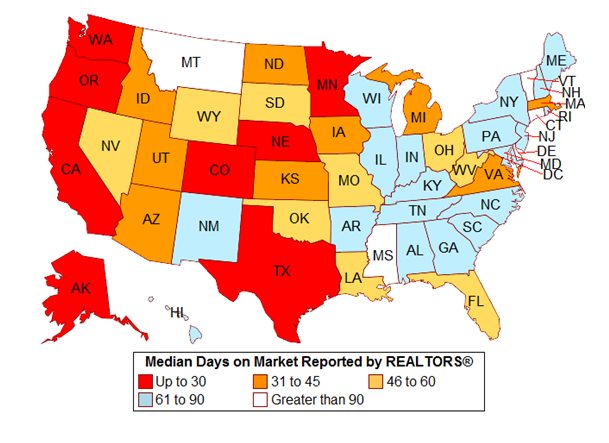

Where Properties Are Selling the Fastest

DAILY REAL ESTATE NEWS | WEDNESDAY, JUNE 08, 2016

Properties are selling faster. Nationwide, properties were on the market for an average of 39 days in April.

Short sales were on the market for the longest amount of time, at 120 days. Foreclosed properties stayed on the market for just 51 days, while nondistressed properties had the fastest sales at 37 days, according to the April 2016 REALTORS® Confidence Index Survey Report.About 45 percent of properties across the country were on the market for less than a month when sold. Only 13 percent were on the market for longer than six months.The markets seeing sales at some of the fastest rates – within a month or less – were the District of Columbia, Washington, Oregon, California, Alaska, Minnesota, Nebraska, Colorado and Texas.Take a look at the chart below to see how quickly homes are selling in your state.

Source: realtormag.realtor.org

Houston Realtor Gives Tour Of The Filthiest Listing You’ve Ever Seen

By Lighter Side Staff

There’s a fine line between fixer-uppers, and homes that simply need to be burned to the ground and wiped from human history. This one’s so bad, though, we’re pretty sure fire would call in sick if it had to burn this house down.

However, Houston Realtor Paul Gomberg, the home’s brave listing agent, didn’t bat an eye when asked to list it. In an interview, he told us he’s more accustomed to selling homes in better condition, but why not accept the challenge of selling this short sale!?

If not him, whom?

And if not now, when?

And as you’ll see in the video below, he played the only card he really had from a marketing standpoint — humor! Well played, Paul.

Oh, by the way. As irony would have it, his slogan is…“KEEP CALM

Buy, List & Sell

with Paul Gomberg”

Ummm we dig the slogan, but that “keeping calm” part is much easier said than done when viewing this home.

Source: lightersideofrealestate.com

15 Glorious Head-Scratchers From The Wild And Crazy World Of Real Estate

By Lighter Side Staff

It’s time for another tour through the strange things discovered by our dedicated fans in the real estate world. If you want to laugh, or just shake your head in bewilderment, you’ll find something here. Remember to take your camera with you when touring homes. You never know when you’ll find treasures like these.

“Oh, the driveway is just for aesthetics.”

That’s one hell of a cat’s scratching post…

You could say this is a beautiful bathroom, but that would be reaching.

Cletus’ famous last words, ‘Pfft! I don’t need no Realtor!’

Use with caution if you’ve had one too many to drink.

Garage door doubles as a state-of-the-art exhaust fan.

Sorry, home warranty doesn’t cover damage to your car’s suspension.

Must’ve been hard to sell the house with that much panda-monium going on.

Depending on interpretation, Mr. Carroll either works for Beer & Associates, or he’s throwing in one helluva bonus.

This home comes with an automated rodent prevention system. Minimal maintenance required.

Master bath comes equipped with built-in poop-pouri circulation system.

Don’t know what’s more bizarre: the wallpaper, the carpet or the elevated toilet.

Note to sellers: wrong choice of decor can make selling a home a tall order.

Camouflaged closet door for the ultimate in clothing security!

“I was looking for an open floor plan, but not quite THIS open.”

Source: lightersideofrealestate.com

One-third of Floridians not prepared for hurricanes

ORLANDO, Fla. – June 6, 2016 – The Atlantic hurricane season is underway with two named storms already in the books, but one-in-three (34 percent) Florida residents don't make advanced preparations, according to a recent AAA Consumer Pulse survey.

Colorado State University predicts a near-average hurricane season with twelve named storms, five hurricanes and two major hurricanes this year. But if a named storm sparked evacuation warnings, nearly 18 percent of residents say they won't leave their homes. Of those who would evacuate, 58 percent say they would only leave for a category three hurricane or greater.

"Residents should stay vigilant and be prepared for a major weather event," said Gene Calkins, Vice-President of Insurance Agency, and AAA, the auto club group. "Part of that preparation includes having a storm kit, evacuation plan and proper insurance coverage, which includes flood insurance."

Floods are the No. 1 disaster in the United States, and homes in low risk zones account for nearly 20 percent of yearly flood claims. Just two inches of water in a 2,000 square foot home, can cause as much as $21,000 or more in damage.

However, 71 percent of Florida residents do not have flood insurance, which is separate from homeowners insurance.

"The majority of residents in Florida do not know there is normally a 30-day waiting period for a new flood policy to take effect," says Josh Carrasco, spokesperson, AAA – The Auto Club Group. "If you wait until a storm is named and heading in your direction, you will be too late. Now is a great time to check with your insurance agent to ensure you are covered before the busy storm season begins."

AAA hurricane preparation tips

• Secure your home: Inspect your home for minor repairs needed to roof, windows, down spouts, etc. Trim trees or bushes that could cause damage in case of high winds.

• Make a plan: Develop a Family Emergency Plan that includes ways to contact each other, alternative meeting locations, and an out-of-town contact person. Identify a safe room or safest areas in your home. Research your evacuation route. Be sure and include plans for pets.

• Take inventory: Update your home inventory by walking through your home with a video camera or smart phone. Keep a record of large purchases including the cost of the item, when purchased and model and serial numbers as available.

• Stock emergency supplies: Plan for a week's worth of non-perishable food and water. Be sure and have flashlights, extra batteries, battery-powered radio, medications, first aid kit, blankets, toiletries, diapers, etc. You may also want to prepare a portable kit and keep in your car should you evacuate.

• Protect your property: Review your homeowners insurance with your insurance agent to determine if you have adequate protection. Discuss your deductibles. Be aware that flood insurance is not typically covered under a homeowners policy. Flooding to an automobile is available under the Physical Damage coverage.

© Copyright 2016 Okeechobee News. All rights reserved.

Source: floridarealtors.org

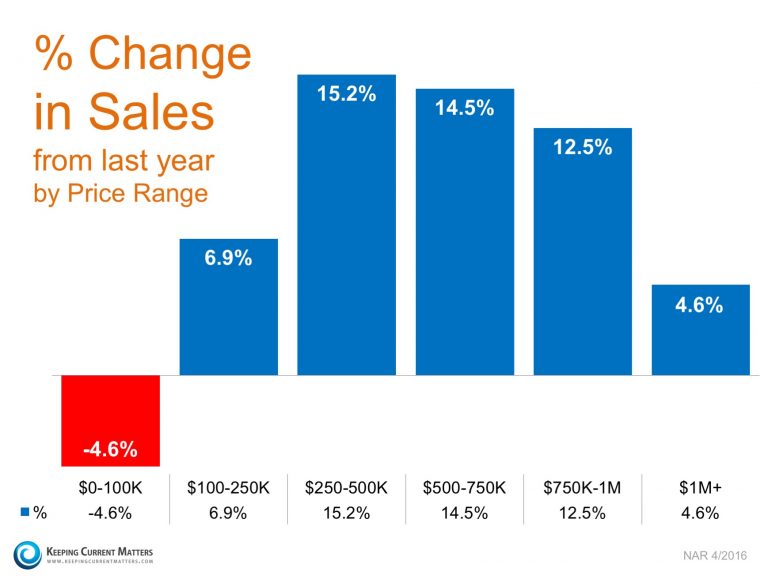

Sales Up In Nearly Every Price Range

By The KCM Crew on May 16, 2016 in For Sellers, PricingAgents, did you know you can share a personalized version of this post? Learn more!

The National Association of Realtors’ most recent Existing Home Sales Report revealed that home sales were up rather dramatically over last year in five of the six price ranges they measure.

Only those homes priced under $100,000 showed a decline (-4.6%). The decline in this price range points to the lower inventory of distressed properties available for sale and speaks to the strength of the market.

Every other category showed a minimum increase of at least 4.6%, with sales in the $250,000- $500,000 range up 15.2%!

Here is the breakdown:

What does that mean to you if you are selling?

Houses are definitely selling. If your house has been on the market for any length of time and has not yet sold, perhaps it is time to sit with your agent and see if it is priced appropriately to compete in today’s market.

Source: keepingcurrentmatters.com

How to Improve Your Credit

Credit scores play a big role in determining whether you’ll qualify for a loan and what your loan terms will be. So, keep your credit score high by doing the following:

Check for errors in your credit report.

Thanks to an act of Congress, you can download one free credit report each year at annualcreditreport.com. If you find any errors, correct them immediately.

Pay down credit card bills.

If possible, pay off the entire balance every month. Transferring credit card debt from one card to another could lower your score.

Don’t charge your credit cards to the max.

Pay down as much as you can every month.

Wait 12 months after credit difficulties to apply for a mortgage.

You’re penalized less severely for problems after a year.

Don’t order items for your new home on credit.

Wait until after your home loan is approved to charge appliances and furniture, as that will add to your debt.

Don’t open new credit card accounts.

If you’re applying for a mortgage, having too much available credit can lower your score.

Shop for mortgage rates all at once.

Having too many credit applications can lower your score. However, multiple inquiries about your credit score from the same type of lender are counted as one if submitted over a short period of time.

Avoid finance companies.

Even if you pay off their loan on time, the interest is high and it may be considered a sign of poor credit management.

Source: realtormag.realtor.org

5 Reasons To Hire A Real Estate Pro

Whether you are buying or selling a home, it can be quite an adventurous journey. You need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but have rather been strengthened due to the projections of higher mortgage interest rates & home prices as the market continues to recover.

1. What do you do with all this paperwork?

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.

2. Ok, so you found your dream house, now what?

According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to make sure that you acquire your dream?

3. Are you a good negotiator?

So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible) to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.

4. What is the home you’re buying/selling really worth?

It is important for your home to be priced correctly from the start to attract the right buyers and shorten the time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to theNational Association of REALTORS, “the typical FSBO home sold for $208,700 compared to $235,000 among agent-assisted home sales.”Get the most out of your transaction by hiring a professional.

5. Do you know what’s really going on in the market?

There is so much information out there on the news and the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a low-ball offer?

Dave Ramsey, the financial guru, advises: “When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has their finger on the pulse of the market will make your buying/selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

Bottom Line

You wouldn’t replace the engine in your car without a trusted mechanic. Why would you make one of the most important financial decisions of your life without hiring a Real Estate Professional?

Source: keepingcurrentmatters.com